Stablecoins serve as a crucial bridge between traditional finance and digital assets like crypto.

This analysis will delve into various aspects, from their growth and real-world use cases to their benefits for the ecosystem, culminating in the battle between Tron and Solana as the future hub for stablecoins. This is significant because the presence of stablecoins makes a blockchain network more vibrant and increases the value of its native token.

However, please remember that this article is not financial advice and does not constitute investment advice.

What is a Stablecoin?

Unlike other cryptocurrencies such as Bitcoin or Ethereum, whose values are highly volatile, a stablecoin is a crypto asset designed to have a stable value.

Take USDT, for example, whose value is pegged to the US Dollar. This means the value of 1 USDT is always intended to be equivalent to $1 USD.

What is the actual purpose of a stablecoin?

The primary goal of a stablecoin is to combine the advantages of crypto such as decentralization and transaction speed with the price stability of conventional currencies. This makes stablecoins more practical for a range of applications, from everyday transactions and trades within the crypto ecosystem to serving as a store of value.

But why can stablecoins also function as a store of value?

The reason is that when an investor or trader has realized a profit from an asset’s price increase—let’s say, Bitcoin—they can sell that Bitcoin and exchange it for a stablecoin (e.g., USDT). By doing so, the value of the investor’s or trader’s profit is “locked in” and will not fall if the price of Bitcoin suddenly drops.

Secondly, for many people in countries with high inflation, the value of the local currency typically decreases over time.

Let’s take the first example from Indonesia. Back in the 1970s and 1980s, a serving of ketoprak (a traditional Indonesian dish) cost only 250 Rupiah. Today, the price for one serving is around 10,000 to 15,000 Rupiah.

Another example is from Argentina. When inflation was soaring, many people exchanged their money for stablecoins like USDT or USDC. These are stablecoins pegged to the US Dollar, making their value far more stable than the local currency, the Peso.

In short, those who exchange the Peso for USDT or USDC aim to preserve their purchasing power.

Clearly, stablecoins have many benefits. But that begs the question: just how significant has their growth been?

The Growth of Stablecoins

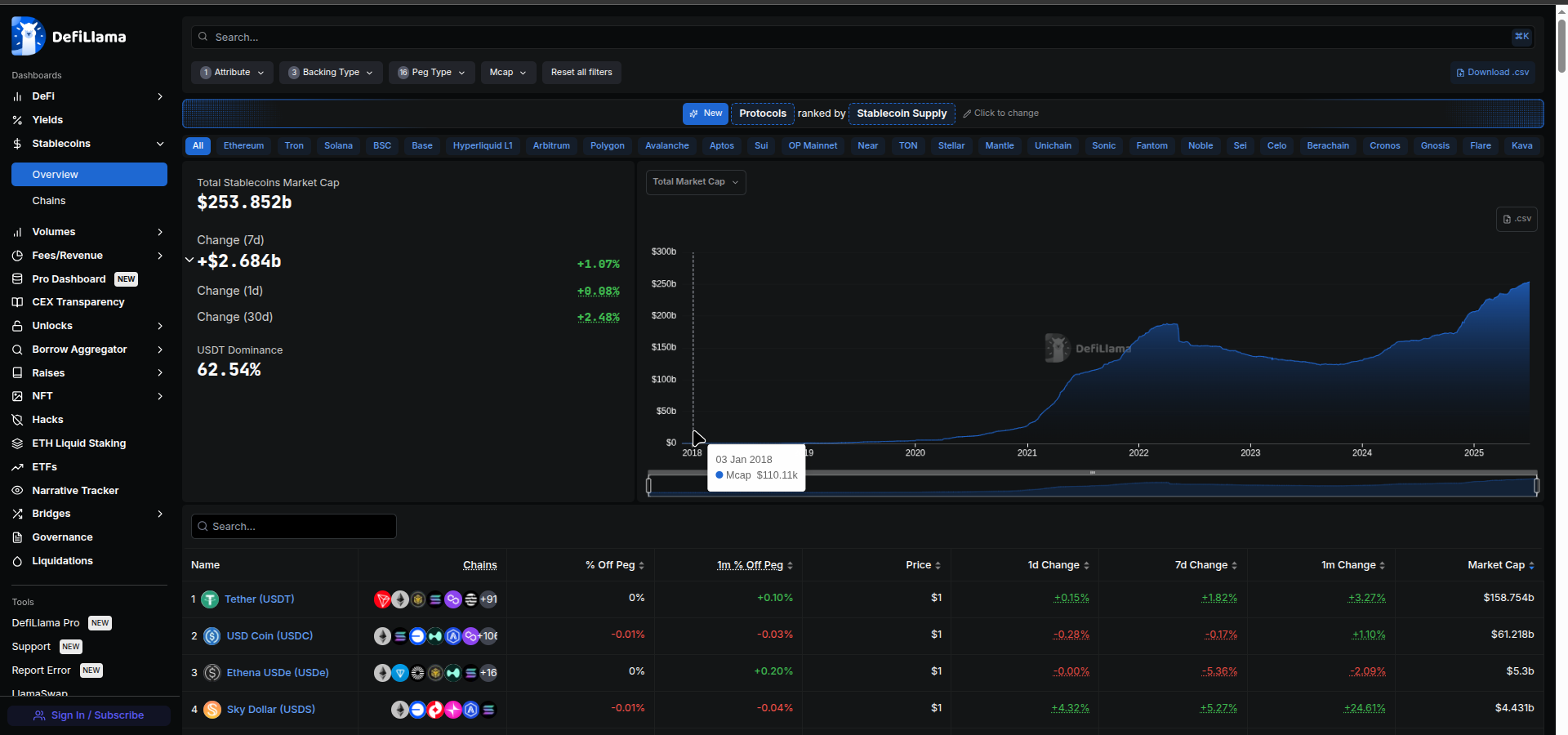

From 2018 to the time of this writing, the stablecoin market is estimated to have grown by an astounding 230.77 million percent. It expanded from just $110.1k on January 3, 2018, to a total of approximately $253 billion in circulation worldwide as of July 1, 2025.

Clearly, this is immense growth, especially considering it has all happened within the last seven years.

USDT is the most dominant.

As you can see in the image above, USDT accounts for 62.54% of all circulating stablecoins, followed by USDC with an estimated 24.12% of the total supply. In third place is Ethena, with approximately 2% of the total circulation.

Clearly, USDT is far ahead of its competitors. Therefore, the upcoming discussion will focus primarily on USDT for now.

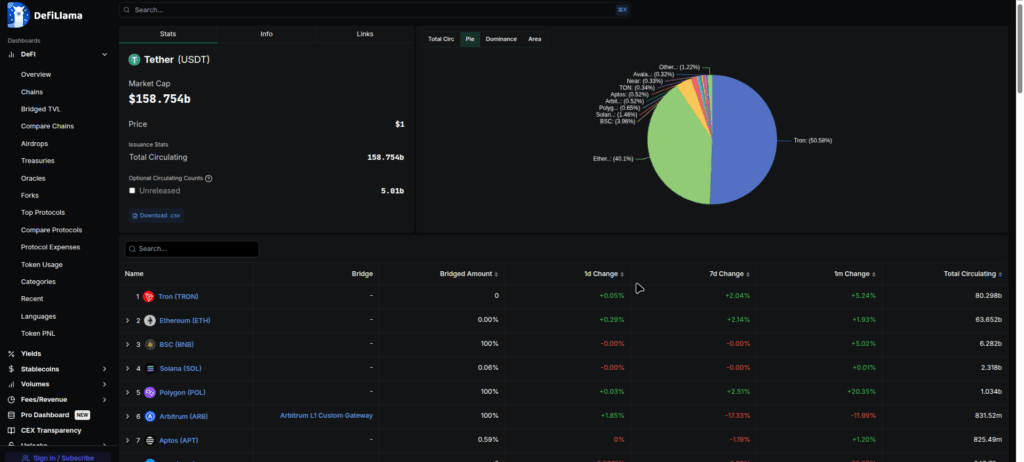

At the time of this writing, USDT’s total market cap stands at approximately $158 billion. This value is distributed across several networks, including Tron, Ethereum, BSC, Solana, and others.

Approximately 50.58%, or about $80 billion, of USDT is on the Tron network, while 40.41% is on Ethereum, 3.9% on BSC, and 1.46% on Solana. Based on this data, if we compare the circulation of USDT on Tron and Solana, the difference is vast.

So why, then, are we comparing TRON and SOLANA as the future hub for stablecoins?

Why not Tron versus Ethereum?

The reason is that this very comparison is being raised by many parties, including crypto investors on social media. Questions are emerging like, “Why isn’t Solana the number one hub for stablecoins?” Many argue that Solana is extremely fast, very cheap, and its network often generates a lot of hype. Therefore, they believe Solana deserves to become the number one stablecoin hub, displacing TRON.

The second reason is that Ethereum can be less reliable during times of network congestion. Currently, Ethereum tends to be expensive and slow. Although Ethereum holds the second spot with an estimated $63 billion in USDT, this is largely because its ecosystem is simply more established than other blockchain networks.

Thus, rather than a direct comparison with Ethereum to be the favored network for global stablecoin users, it might be more fitting to compare it with Layer-2 solutions like Optimism and Arbitrum, which are also fast and cheap. (There will be a future discussion on this as well).

So, why isn’t the future of stablecoins on BSC?

Although BSC is currently ranked third on DefiLlama, many feel that Solana still holds far more future potential. Solana has been more successful in building an image as a project driven by its community and innovative technology. This makes Solana appear more appealing and “sexy” compared to BSC.

Disclaimer: This does not mean we are giving special treatment to Solana; the context here is strictly about which network has the potential to become a stablecoin hub, as Solana itself actually has many weaknesses.

What are the benefits for a blockchain if its network becomes a global stablecoin hub?

First, the network appears more vibrant and active, unlike a dead or dormant chain.

Second, demand for the native token (in this case, TRX and SOL) increases because every transaction involving USDT or USDC requires the native token for gas fees. This means the native token gains real utility; there is clear demand for it because it’s genuinely needed for daily operations. In other words, the token becomes more than just a speculative asset.

Third, it generates revenue for the blockchain network, which is then distributed to validators as an economic incentive. This revenue is crucial to motivate them to continue securing and operating the network.

Fourth, if a blockchain becomes a global stablecoin hub, it will attract more developers and new projects. The reason is simple: DApp developers will build where the money and the users are. The presence of tens of billions of dollars in stablecoins on a network is a strong signal to DApp developers that there is a ready market for their products.

Fifth, stablecoins serve as a crucial liquidity foundation for DeFi.

Assessing the Future Stablecoin Hub: Tron vs. Solana?

Given the many benefits, predicting which network has the potential to become the stablecoin hub is an increasingly interesting prospect. For this specific discussion between Tron and Solana, we must establish objective indicators to serve as benchmarks.

There are six indicators that can be used:

- Throughput & Scalability. This refers to a blockchain network’s ability to process a large number of transactions per second.

Theoretically, the Tron network can process up to 2,000 transactions per second (TPS). In contrast, Solana can theoretically handle 65,000 TPS, with a block time of around 400 milliseconds. Furthermore, with the Firedancer client, Solana’s throughput in testnet trials has theoretically reached up to 1 million TPS.

Admittedly, real-world performance will be lower for both Tron and Solana. However, the actual results are not expected to deviate significantly from their theoretical and testnet figures. - Transaction Costs. This factor is crucial for mass adoption and micropayment use cases.

In fact, this relates to a common question from investors on social media: “Why isn’t Solana the global stablecoin hub?” This question is largely driven by transaction costs, as fees on Solana are extremely low, averaging only about $0.00064 per transaction and rarely exceeding $0.0025.

What about Tron?

Tron can actually be free, as it uses a bandwidth and energy system, provided that the user has staked TRX tokens beforehand. - Reliability & Uptime. What good is being fast and cheap if the network is unusable? So, this factor is also crucial.

On this front, Tron has the upper hand because, in the past, Solana frequently experienced outages, primarily due to transaction spam issues.

What about today? Currently, Solana rarely, if ever, experiences outages. Moreover, with the introduction of the Firedancer client, Solana has become much more resilient against such problems.

But still, from a historical perspective, people will tend to trust Tron more because its network is more time-tested—especially when it comes to stablecoin transactions, which are ultimately about “money.” Therefore, the majority of large investors will likely lean towards the option that is most reliable under any circumstance. - Decentralization & Network Security. Imagine this, there is approximately $80 billion in USDT on Tron. If the blockchain network securing that much money isn’t safe, it becomes incredibly dangerous.

In terms of decentralization, Solana is far superior to Tron. Solana has approximately 1,033 validators, whereas Tron has only about 27.

What about their security?

With thousands of validators, it is theoretically very difficult for an attacker to gain control of the Solana network. The cost of an attack would be prohibitively expensive. Thus, cryptographically, Solana is very secure.

However, its history of outages and downtime can be seen as a security weakness. From a stablecoin user’s perspective, an inaccessible network is equivalent to an insecure one because their funds are “locked”—unable to be accessed or used.

And on Tron?

With only 27 validators, the Tron network is theoretically more vulnerable, especially to collusion. For example, a government or a powerful entity could pressure a majority of these 27 validators to compromise the network. As a result, this entity could potentially block transactions from certain addresses. This scenario is a prime example of the real-world risks of centralization in crypto.

However, Tron’s near-perfect uptime (approaching 100%) can also be considered its main security strength. This gives stablecoin users on the TRON network an assurance that the network will always be functional for sending and receiving USDT at any time. - Ecosystem. Generally, the more established and diverse a blockchain’s ecosystem is, the more attractive it becomes for stablecoins to reside on that network.

From its inception, the Tron ecosystem was specifically designed and planned for the stablecoin market. It doesn’t try to be everything to everyone. Its primary strength lies in its clear and sharp focus on doing one thing exceptionally well: facilitating USDT transfers.

This is clearly evident in its real-world utility, where Tron is the top choice in many developing nations for remittances and daily payments due to its low costs and reliability (referencing its previously mentioned uptime). Furthermore, Tron is integrated with nearly every crypto exchange worldwide.

Finally, applications on Tron tend to be user-friendly and less complex than the DeFi protocols on Solana. This makes Tron more beginner-friendly for those whose sole purpose is to send and receive money in the form of USDT.

Solana, on the other hand, can be described as a place where experimentation and innovation happen at a rapid pace. The strength of its ecosystem lies in its diversity and the network effects generated by thousands of interconnected applications. - Institutional Trust & Compliance. This is also important because the network’s perception in the eyes of regulators, financial institutions, and other corporations will determine whether or not it achieves mainstream adoption.

Think of it this way, an institution will not place large sums of money on a network if that network has legal issues or does not comply with local laws, because their otherwise “clean” money could become tainted.

To this end, Solana has positioned itself from the beginning as a high-performance blockchain infrastructure suitable for large-scale applications, including institutional finance.

For instance, Solana has forged partnerships with Visa, Shopify, and Google Cloud. It has also received significant support from VCs, and through its Solana Foundation, it actively engages in policy discussions in Washington, D.C., and other jurisdictions. This signifies that Solana is not trying to evade regulators, but rather to collaborate with them.

Furthermore, Donald Trump also once expressed interest in making Solana part of the nation’s strategic reserves, alongside Bitcoin. Although this has not yet materialized, the fact that a figure of Trump’s stature, as the US President in 2025, would make such a statement strongly suggests a high level of institutional confidence in Solana as well.

What about TRON?

With Tron, the situation is quite different. In 2023, Tron was sued by the SEC for Fraud and Other Securities Law Violations. Not to mention, its founder, Justin Sun, frequently attracts negative attention.

Therefore, in the category of Institutional Trust & Compliance, Solana has the clear advantage.

But why, then, is Tron still the king of stablecoins, especially USDT? This is despite the fact that, based on our analysis, Solana has superior Throughput & Scalability, seemingly better Decentralization & Security, and even appears to have an edge in Institutional Trust & Compliance.

The most logical answer to this is:

- Timing is Everything

TRON’s major breakthrough came during the Ethereum “gas fee crisis” of the 2020-2021 bull run. At that time, transaction fees on Ethereum skyrocketed to unreasonable levels, even for small-scale transactions. Everyone from retail users to Centralized Exchanges (CEXs) was driven to despair by these fees. This situation ultimately forced everyone to look for alternatives. At that moment, TRON already existed, its network was mature, and it was ready to accommodate the influx. Meanwhile, other networks like Solana were not yet as popular or as integrated as they are today. - A Clear and Sharp Focus

Tron concentrates on a single use case: serving as a fast and cheap settlement layer for payments. This singular focus has allowed Tron to become highly optimized.

To use an analogy, Solana is like a bustling metropolis filled with sophisticated technology. It features advanced systems, diverse economic activities, and comprehensive infrastructure—in essence, it is complex.

Tron, on the other hand, is like a highway designed for a single purpose: facilitating traffic. In this context, Tron is specifically focused on being a conduit for money transfers, primarily USDT. Furthermore, the infrastructure Tron has built was intentionally designed from the ground up to be a global stablecoin hub.

These two factors mean that Tron’s user base is predominantly Centralized Exchanges (CEXs). CEXs typically stake enormous amounts of TRX tokens with the goal of obtaining a vast amount of bandwidth and energy. This is because, with this bandwidth and energy, users can transact on the Tron network for free—literally zero cost.

For a CEX with millions of users, zero-cost transactions are extremely advantageous.

For example, if a CEX sends USDT 100,000 times in one day, that amounts to 3 million times a month. Imagine if they used Solana; based on the highest fee mentioned earlier, the CEX would have to pay around $7,500 per month, which comes to about $90,000 per year.

If the CEX uses the Tron network, the cost can be zero, provided, as mentioned, that they stake TRX tokens first.

Retail users would typically worry about impermanent loss from staking, but a CEX does not. The CEX will hedge its position to secure the value of the staked TRX tokens. Not to mention, the CEX also earns a staking yield of around 4% per year, so it actually ends up being profitable.

So, on Solana, a CEX would have to pay a fee of, say, $90,000 per year, whereas on Tron, the CEX actually earns a profit of around 4% annually.

In conclusion, it is highly likely that Tron will continue to dominate the stablecoin market, particularly for USDT, for the next 5-7 years, while Solana will be more focused on USDC, as its partnership with Circle is also highly influential.

But the key point, in the context of which will become the stablecoin hub, is that these two blockchains aren’t really competing; they are more complementary.

Tron will continue to be favored by institutions that process high volumes of daily transfers, particularly CEXs, and it will remain widely used by the unbanked majority in developing nations. Solana, on the other hand, will be preferred by startups and by users who only occasionally send USDC—for instance, making just 5 USDC transfers a day is far cheaper than having to stake TRX first. It will also be favored by users in developed countries who require complex and sophisticated DApp infrastructure.

Tron and Solana each have their own target markets. In fact, as alluded to at the beginning of this article, a more fitting competition for Solana is with chains like Optimism or Arbitrum, as they are all fast, cheap, and provide access to a wide range of sophisticated DApps.